Blog #1 - Racism, Hypocrisy & Potatoes

March 22, 2020

Hello and welcome to my first blog, tatter-tot. If you do not know me, my name is Andrew, I am 22 years old (edging on 7 mentally), I am a 2nd generation Chinese American (ABC), and I love potatoes.

I also love sociology, hash browns, psychology, fries, economics and the future of MERICA.

Today's blog is focused on recent events of Coronavirus, followed by my economic throw-up , and potatoes of course.

To make matters worse, the Cheeto Puff is throwing Chinese people under the bus to wipe his own ass. If you are Asian American, this is dangerous to you because:

To make matters worse, the Cheeto Puff is throwing Chinese people under the bus to wipe his own ass. If you are Asian American, this is dangerous to you because:

|

| Andrew, circa 2020 |

I also love sociology, hash browns, psychology, fries, economics and the future of MERICA.

Today's blog is focused on recent events of Coronavirus, followed by my economic throw-up , and potatoes of course.

The Invisible Hand of Coronavirus

I know as much biology as my Mom knows cooking, and trust when I say I grew up skinny for a reason. Instead of discussing the symptoms the virus has on the body, I will be discussing the symptoms it has on society. Before I barf on you my anecdotal views, I would like to share the wise words of modern day philosopher, Jay Park:

"Born in this country, but I'm feeling like an immigrant."

I grew up in Sacramento, one of the most diverse cities in the US. As much as I would love to believe the fairy tale that children do not see race, my personal experiences have denied me that privilege since I was in first grade. I got bullied for being Chinese by a plethora of groups: White, Black, Mexican, Indian, Hmong, Filipino... shit you name it. I hold no resentment against any group because my friends of such groups are more important to me.

What I came to realize after being called "chink" or "gook" by different people was that we all go a little hate in our blood - racists discriminate, but racism doesn't. People are like potatoes - we come in different colors, and there are a couple bad potatoes in every bunch. Every race has that person that makes them think "Bruh, why you got to be one of us....making us look bad." If you are going to fight me on the whole "race is a social construct, it doesn't exist" argument, please note that the perception of race is very real, and hence the effects as well. Since going to college, I haven't felt the potential of danger for being who I am, until now.

Coronavirus has given a lot of people an excuse to unload their anger and frustration onto Asian Americans. The one that frustrated me the most was the elderly Chinese man that got attacked in SF who was collecting cans and had them stolen away. This video triggered the fuck out of me because:

1) Seeing this older man reminds me of my grandfather, and I think anyone can understand the rage you feel if someone were to attack your grandparents.

2) Is this really the country we live in? I see American news bashing China all the time, but for those who have actually been to China, you know we take care of our elderly. In China, people are expected to give up their seats on busses to the elders. We take care of our own. Events like this make me want to throw up about the moral superiority a lot of Americans seem to carry. As American's, do we take care of our own? Fact is, there are plenty of morally righteous people outside the US, you just don't see them in your news feed.

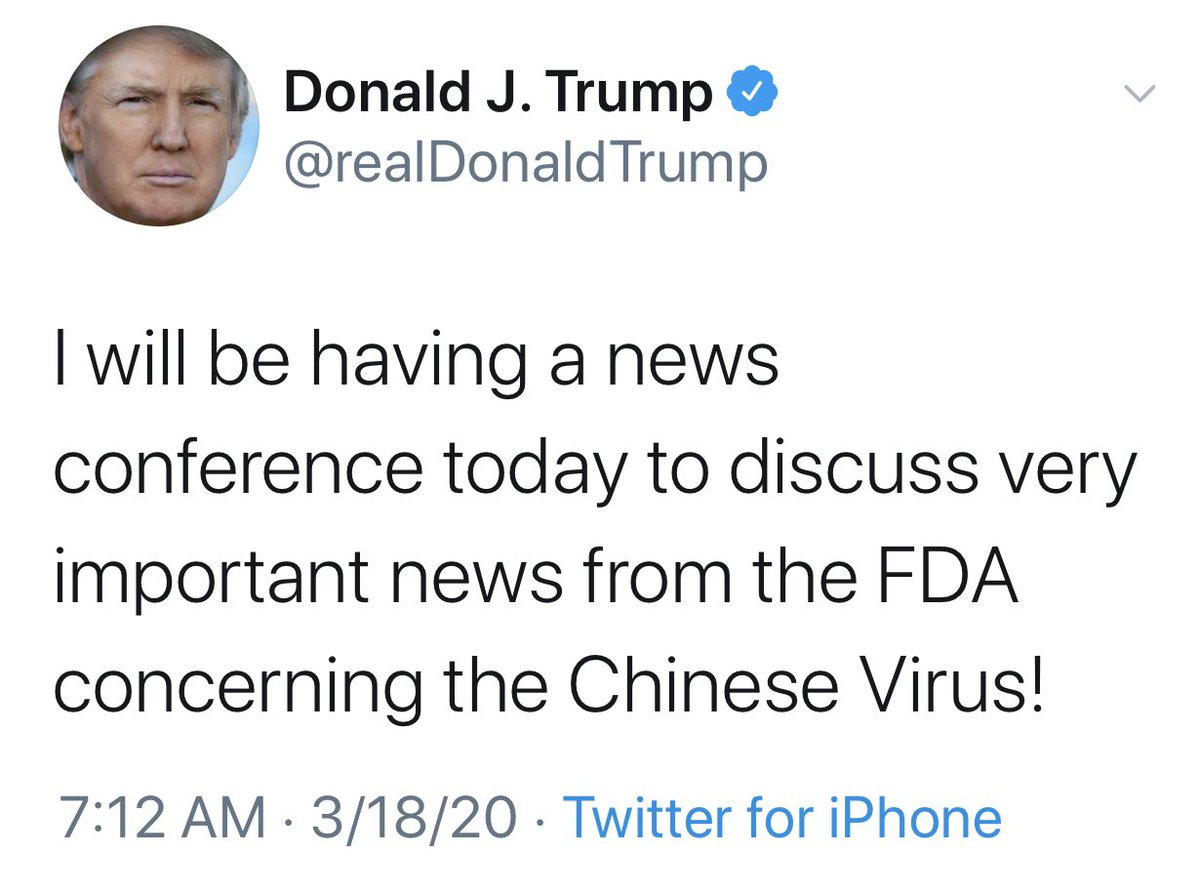

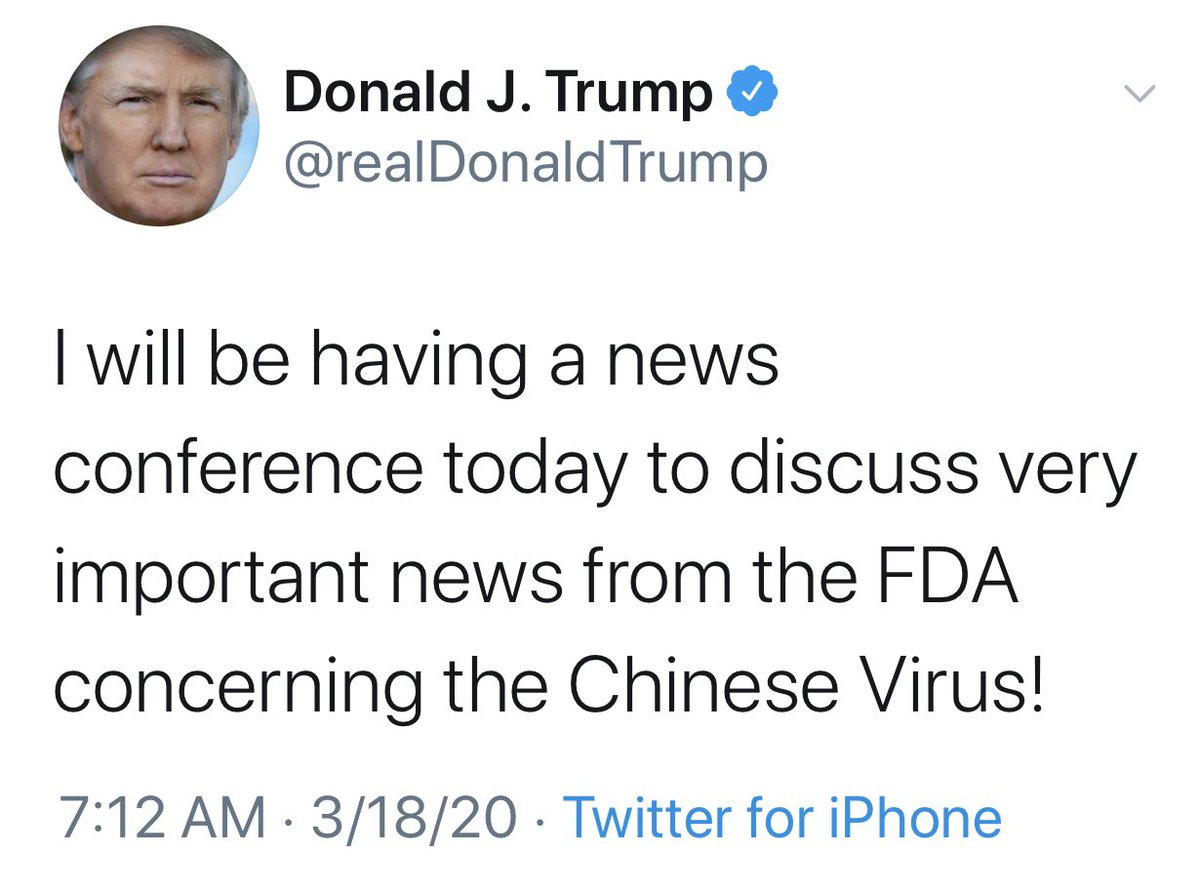

To make matters worse, the Cheeto Puff is throwing Chinese people under the bus to wipe his own ass. If you are Asian American, this is dangerous to you because:

To make matters worse, the Cheeto Puff is throwing Chinese people under the bus to wipe his own ass. If you are Asian American, this is dangerous to you because:

1) Bruh, other races can't really tell the difference between Chinese people and other Asians in terms of how we look.

2) #1

Prediction: Trump is going to push the narrative that the US economy was ROARING until the "CHINESE virus" hit, and everything went to shit. Basically, "iT wAsNt mY faUlt".

Economic Outlook (& Potatoes)

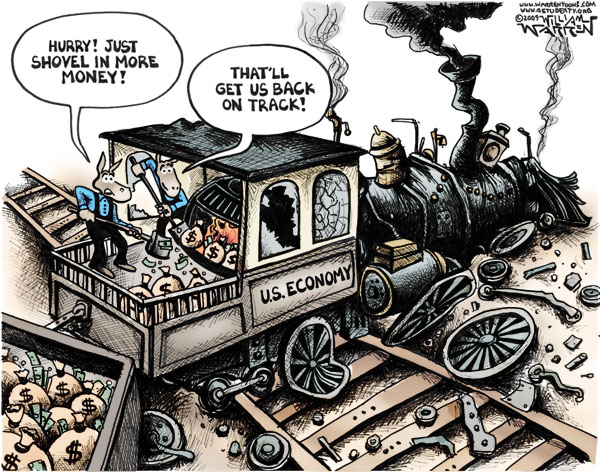

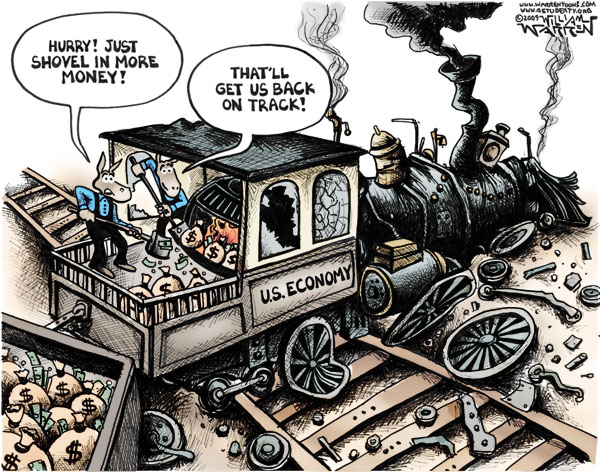

Let's be honest, our economy has been shit for years, but we just don't want to admit it because everyone bought into the lie sold to us by our government and the media. Here is a little crash course on the US economy using potato analogies:

The US Government is a potato - let's call him Spud. Spud is a potato that DJ's, hosting potato parties for his potato friends. Spud venmo requests his potato friends every year for hosting the party. The venmo request is different per potato friend based on how much vodka they drank (hehe, get it?).

Spud is currently $23000 in debt to his non-potato buddies (Carrot, Onions, Garlic, etc.). Of all of Spud's potato friends who are attending the party, their net income per year is $21000.

3 years ago, Spud overspent by $50 for his parties.

2 years ago, Spud overspent by $80 for his parties.

1 year ago, Spud overspent by $100 for his parties.

This year, we do not know if Spud overspent, but we do do know he just posted a venmo request for an unexpected $1600.

This is where to potato analogy ends. For the past 11 years, the US economy has been doing "well" according to the news, especially in terms of the stock market, GDP, and unemployment.

1) "Dow soars, wages don't." - Alexandria Ocasio-Cortez

Not everyone owns stock, first off. Second of all, stock prices can increase for a multitude of reasons, and just because the stock price is increasing does not mean the company is performing better.

2) GDP per capita is not a holistic measure of the economy because of wealth distribution (or lack thereof) - the nation can have more wealth than ever before, but that does not mean Joe Schmoe has a fatter bank account - most Joe's have less than before.

3) Unemployment rate can be decrease because people are working part time jobs, which are much different from full time jobs in terms of stability, benefits, and pay. That is why the unemployment rate will increase faster than ever before (just look at jobless filings since Coronavirus).

Coronavirus is dangers to our economies for the following reasons:

1) Unemployment and Negative Feedback Loop

We are entering a negative feedback loop right now because of Coronavirus: lots of smaller businesses (restaurants, boba shops, department stores, etc.) cannot survive long periods without cash. Hence, they start laying people off. The problem is severe because the effect compounds: when one person get's laid off, their income is reduced and in turn their spending. Their spending is another person's income, etc etc. If you do this couple million times, the effect is everyone spends less and makes less.

2) Banks

Banks are more leveraged (aka they borrowed more money) than they were in 2008. The more leverage, the more a recession is going to hurt. In my opinion, banks are the way they are not because they are evil people, rather the government has created a moral hazard: banks have been incentivized by policies that encourage excessive risky behavior. FDIC insurance ensures that your money is protected by the government if banks collapse, the requirement rate for banks was reduced to zero recently by the Fed, and the government has a history of bailing out large corporations.

When banks collapse and the government does not bail them out, people cannot withdraw money. Imagine if you couldn't withdraw/use the money in your bank account. That is a potential reality of banks failed, and I don't really want to think about the shit ton of problems to follow if people no longer have the ability to withdraw their savings during a crisis.

3) US Dollar

One very important privilege that few Americans grasp is the power that comes from a strong dollar - with a strong dollar, you can print it out of thin air and use it to buy potatoes from any country that accepts your dollar. The reason why the US has been trending towards trade deficits with various countries is because the dollar is strong, and it is cheaper for us to import it than to make it ourselves. We have been doing a lot of importing/outsourcing over the years (just look at the country of origin for your wardrobe). It is because of this dollar (and the printing of it) that the US has been able to continue importing goods from across the world while not exporting as much: so long as the world accepts the dollar, we can create it whenever we want and use it to buy stuff made by people in other countries.

The government is in the process of approving a $1.6T stimulus package, which in simple terms means we are going to print the money out of thin air and use it to fight Coronavirus and help Americans in times of need. Although the intent is good, I question the impact this will actually have on the dollar. The US is in a dilemma: we need to print more to finance the health and wellbeing of Americans, but at the same time, if we print too much money the world might refuse to accept our dollar for its current value, which would send send costs in the US through the roof as we wouldn't be able to import our goods so cheaply.

That is why calling for "socioeconomic equality for all" comes with hypocrisy as an American. Who is included in "all?" If "all" refers to everyone globally, then America would collapse because we as a country have been benefitting off the labor of workers across the world economy. Not saying the US shouldn't have more socioeconomic equality, rather we are only looking at it from a selfish perspective that benefits us.

So for anyone who holds a very strong opinion on what the government should do, I employ you to think about the costs. I for one, do not know if there is a "right" answer. The more you look into these issues, the more complex the solutions become.

On a happier note, you can buy 8 McDonald's quality hash browns from Trader Joes for $2!

-Andrew

This is where to potato analogy ends. For the past 11 years, the US economy has been doing "well" according to the news, especially in terms of the stock market, GDP, and unemployment.

1) "Dow soars, wages don't." - Alexandria Ocasio-Cortez

Not everyone owns stock, first off. Second of all, stock prices can increase for a multitude of reasons, and just because the stock price is increasing does not mean the company is performing better.

2) GDP per capita is not a holistic measure of the economy because of wealth distribution (or lack thereof) - the nation can have more wealth than ever before, but that does not mean Joe Schmoe has a fatter bank account - most Joe's have less than before.

3) Unemployment rate can be decrease because people are working part time jobs, which are much different from full time jobs in terms of stability, benefits, and pay. That is why the unemployment rate will increase faster than ever before (just look at jobless filings since Coronavirus).

Coronavirus is dangers to our economies for the following reasons:

1) Unemployment and Negative Feedback Loop

We are entering a negative feedback loop right now because of Coronavirus: lots of smaller businesses (restaurants, boba shops, department stores, etc.) cannot survive long periods without cash. Hence, they start laying people off. The problem is severe because the effect compounds: when one person get's laid off, their income is reduced and in turn their spending. Their spending is another person's income, etc etc. If you do this couple million times, the effect is everyone spends less and makes less.

2) Banks

Banks are more leveraged (aka they borrowed more money) than they were in 2008. The more leverage, the more a recession is going to hurt. In my opinion, banks are the way they are not because they are evil people, rather the government has created a moral hazard: banks have been incentivized by policies that encourage excessive risky behavior. FDIC insurance ensures that your money is protected by the government if banks collapse, the requirement rate for banks was reduced to zero recently by the Fed, and the government has a history of bailing out large corporations.

When banks collapse and the government does not bail them out, people cannot withdraw money. Imagine if you couldn't withdraw/use the money in your bank account. That is a potential reality of banks failed, and I don't really want to think about the shit ton of problems to follow if people no longer have the ability to withdraw their savings during a crisis.

3) US Dollar

One very important privilege that few Americans grasp is the power that comes from a strong dollar - with a strong dollar, you can print it out of thin air and use it to buy potatoes from any country that accepts your dollar. The reason why the US has been trending towards trade deficits with various countries is because the dollar is strong, and it is cheaper for us to import it than to make it ourselves. We have been doing a lot of importing/outsourcing over the years (just look at the country of origin for your wardrobe). It is because of this dollar (and the printing of it) that the US has been able to continue importing goods from across the world while not exporting as much: so long as the world accepts the dollar, we can create it whenever we want and use it to buy stuff made by people in other countries.

The government is in the process of approving a $1.6T stimulus package, which in simple terms means we are going to print the money out of thin air and use it to fight Coronavirus and help Americans in times of need. Although the intent is good, I question the impact this will actually have on the dollar. The US is in a dilemma: we need to print more to finance the health and wellbeing of Americans, but at the same time, if we print too much money the world might refuse to accept our dollar for its current value, which would send send costs in the US through the roof as we wouldn't be able to import our goods so cheaply.

That is why calling for "socioeconomic equality for all" comes with hypocrisy as an American. Who is included in "all?" If "all" refers to everyone globally, then America would collapse because we as a country have been benefitting off the labor of workers across the world economy. Not saying the US shouldn't have more socioeconomic equality, rather we are only looking at it from a selfish perspective that benefits us.

So for anyone who holds a very strong opinion on what the government should do, I employ you to think about the costs. I for one, do not know if there is a "right" answer. The more you look into these issues, the more complex the solutions become.

On a happier note, you can buy 8 McDonald's quality hash browns from Trader Joes for $2!

-Andrew

Actual Numbers if you care:

Government debt: $23.6T

US GDP 2019: $21.4T

Stimulus Package: $ 1.6T (est.)

US Deficit 2019: $984B

US Deficit 2018: $779B

US Deficit 2017: $503B

Comments

Post a Comment